Big U.S. Internet computing companies ought to surpass their plainer PC cousins when revenue season kicks off next week, as corporations and fast-growing Web players dramatically speed up their rate of hardware expenses.

Corporations are gradually more turning to new technology in making themselves more productive in a downtrodden global economy. In the meantime, a social networking and e-commerce boom spurs massive outlays on the giant server factories, powering Internet computing.

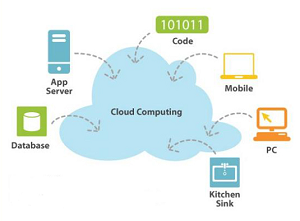

That is finest news for Intel Corp that supplies more of its microchips direct to companies building their own servers, and firms like EMC Corp and VMware whose businesses are essential to the storage and transmission of isolated data, known as “cloud computing”.

But it is less of a benefit for conventional hardware makers such as Dell Inc and Hewlett Packard Co, finding them selling PCs at low margins and struggling in coping with a hastening migration to smartphones and tablets.

Facebook, similar to online leaders Amazon.com and China’s Baidu, buys masses of equipment in filling l two main data centers in Oregon and North Carolina. However, they do not like to buy whole servers from HP or IBM. They are just going to build themselves with the component coming from top component makers such as Intel.

Apple Inc, which reports on Tuesday, continues in defying the economy and astounds Wall Street by luring ever more consumers in buying its newest gadgets.

However, most other hardware companies are shuffling along, with little sign of a recovery ahead.

However, most other hardware companies are shuffling along, with little sign of a recovery ahead.

Worldwide PC sales hardly rose over 3 percent last quarter over last year’s numbers, based on the research coming from leading research firms.

Gartner last month cut its yearly PC sales progress forecast to 3.8 percent, down from its earlier projection of 9.3 percent.

The knock-on effect upsets Intel’s conventional business of supplying chips for PCs, but it especially hits Microsoft Corp, relying on PC sales in keeping its core Windows and Office products growing, regardless of making modern inroads into the cloud market with its server software and Azure developer platform.

Wall Street is anticipating a modest 9 percent rise in IBM’s periodical net profit when it reports on Monday, and a 6 percent increase from Microsoft on Thursday. Intel, reporting on Tuesday, projected in posting a 12 percent increase.

VMware, the small but a fast-growing leader in analytical or “virtualizing” working systems onto computers via the Internet, also reports earnings on Monday, with analysts’ forecasting a 30 percent jump in net profit.